- Investor Home

- Corporate Governance

- Governance Architecture

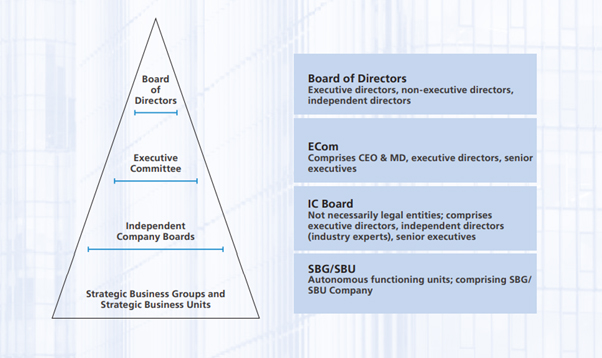

Governance Architecture

Governance ArchitectureOur Company operates through a 4-tier management structure, which enables functioning of the business in an orderly manner with two-way feedback and communication methods established between different levels. The governance structure helps ensure greater management accountability and credibility, and facilitates enhanced business autonomy, performance discipline and development of business leaders

The Corporate Governance framework in the Company is based on an effective independent Board, the separation of the Board's functions of governance and executive management and the constitution of Board committees generally comprising a majority of independent Directors.

The Board of Directors comprises Chairman & Managing Director, 5 Executive Directors, and 10 Non-executive Directors.

Terms of reference:

- The Audit Committee oversees the Company's financial reporting process and disclosure of its financial information, to recommend the appointment of Statutory Auditors and fixation of their remuneration, to review and discuss with the Auditors about internal control systems, the scope of audit including the observations of the Auditors, adequacy of the internal audit system, major accounting policies, practices and entries, compliance with accounting standards and Listing Agreements entered into with the Stock Exchanges and other legal requirements concerning financial statements and related party transactions, if any, to review the Company's financial and risk management policies and discuss with the Internal Auditors any significant findings for follow-up thereon, to review the functioning of the whistle blower mechanism, to review the Quarterly, Half-yearly and Annual financial statements before they are submitted to the Board of Directors.

- The Committee also meets the operating management personnel and reviews the operations, new initiatives and performance of the business units. Minutes of the Audit Committee Meetings are circulated to the Members of the Board, discussed and taken note of. The Audit Committee of the Board of Directors was formed in 1986 and comprises four Non-Executive Directors

- The Chief Financial Officer and Chief Internal Auditor are permanent invitees. The Company Secretary is the Secretary of the Committee.

Composition:

Audit Committee presently comprises of 3 Independent Directors. They are as follows:

- Mr. P. R. Ramesh (Chairman)

- Mr. Sanjeev Aga

- Mr. Rajnish Kumar

Terms of reference:

- The Committee shall identity and recommend to the Board the persons who are qualified to be the directors, to formulate criteria for determining qualifications, positive attributes and independence of a director and recommend to the board of directors a policy relating to the remuneration of the directors and key managerial personnel and to devise a policy on diversity of board of directors.

- The Committee shall also formulate criteria for evaluation of performance of independent directors and the board of directors and consider whether to extend or continue the term of appointment of the independent directors, on the basis of the report of performance evaluation of independent directors.

Composition:

The committee comprises 3 Independent Directors and the Chairman and Managing Director of the Company. They are as follows:

- Adil Zainulbhai – Chairman

- S N Subrahmanyan

- Narayanan Kumar

- Pramit Jhaveri

Terms of reference:

- To look into the investors' complaints, if any, and to redress the same expeditiously. Besides, the committee approves allotment, transfer and transmission of Shares, Debentures and any other securities and issue of duplicate certificates and new certificates on split/consolidation/renewal etc. as may be referred to it by the Share Transfer Committee.

Composition:

The Stakeholders Relationship Committee presently has 1 Non-Executive Director, 1 Independent Director and one Executive Director. They are as follows:

- Narayanan Kumar - Chairman

- T Madhava Das

- Hemant Bhargava

The CSR Committee shall formulate and recommend to the Board:

Corporate Social Responsibility

- A Corporate Social Responsibility Policy and suggest any changes thereto.

- Provide guidance for the development of annual CSR Action Plan

- The CSR annual budget to the Board for approval

- Monitor the implementation of the CSR Action Plan of the Company from time to time; and

- Identify and recommend to the Board the CSR projects that will qualify to be ongoing projects

Sustainability:

- A Sustainability Policy and suggest any changes thereto

- Provide guidance for the development of the long-term Sustainability Plan; and

- Monitor the implementation of the Sustainability Plan of the Company from time to time

Composition:

Corporate Social Responsibility Committee presently comprises of 2 Independent Director and 2 Executive Directors.

- Mr. Ajay Tyagi (Chairman)

- Mr. R. Shankar Raman

- Mr. S. V. Desai

- Mr. Jyoti Sagar

Terms of reference:

- Review of the existing Risk Management Policy, framework and processes, Risk Management Structure and Risk Mitigation Systems. Broadly, the key risks will cover strategic risks of the group at the domestic and international level, including sectoral developments, risk related to market, financial, geographical, political and reputational issues, Environment, Social and Governance (ESG) risks, etc.

- Evaluate risks related to cyber security.

Composition:

Board Risk Management Committee presently comprises of 2 Independent Directors and 1 Executive Director. They are as follows:

- Adil Zainulbhai (Chairman)

- Sanjeev Aga

- Subramanian Sarma

Chief Risk Officer - R. Govindan, Executive Vice President (Corporate Finance & Enterprise Risk Management)

Shareholder Services

L&T Group

L&T Group Company Philosophy

Company Philosophy Organization Chart

Organization Chart